Top 4 financial ratio to determine if a business is profitable or not:

Profitability refers to the company’s ability to generate profits and achieve sustained financial growth over time. It is determined based on the ratio of income to expenses of the company. Put simply, when a company’s revenue exceeds its expenses, it is considered profitable.

However, achieving and maintaining profitability requires careful financial management, strategic decision making and a stern focus on KPIs. Businesses must closely monitor their revenues, control their expenses, optimize operational efficiencies, and adapt to changing market conditions.

It should be noted that profitability is not the only measure of a company’s success. Some businesses, particularly startups or startups, may value growth and market share over immediate profitability. In such cases, profitability may be temporarily sacrificed in favor of increasing fuel economy and capturing greater market share. But even in these cases, the path to profitability should be a crucial long-term factor.

Profitability is an important aspect of running a successful business.Indicates ability to generate a return on investment and sustain financial growth. By focusing on key profitability metrics and implementing sound financial management practices, companies can increase their chances of long-term success.

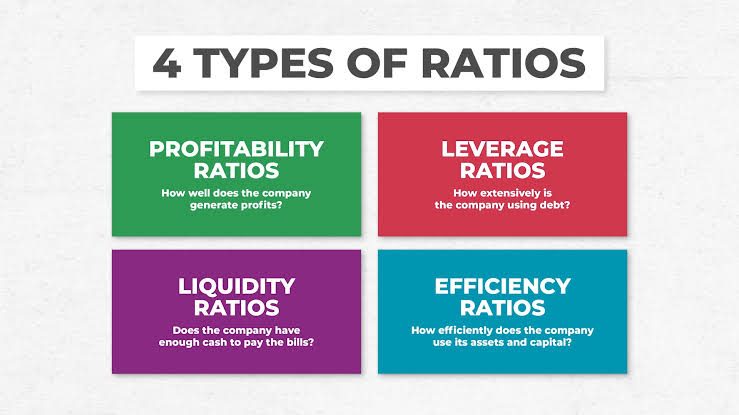

The Analysis of financial ratios is important in understanding the company’s financial condition and determining its profitability. By analyzing key financial metrics, investors, analysts and entrepreneurs can gain valuable insights into business performance and make informed decisions. In this blog post, we take a look at the four key financial indicators you can use to determine if a company is profitable or not. These reports provide a comprehensive view of a company’s profitability and allow interested parties to assess its financial viability.

Financial reports are powerful tools for assessing a company’s financial health and performance. They provide valuable information on various aspects of business operations, profitability, liquidity, solvency and efficiency. Analysis of financial metrics enables investors, analysts and stakeholders to make informed decisions and assess the company’s overall financial condition.

Key Financial Ratios:

1.Liquidity Ratio: measures the company’s ability to pay off short-term debt.

– Quick Ratio: Evaluates a company’s ability to meet its immediate cash needs without relying on inventory.

2. Profitability Ratios:

– Gross Profit Margin: Indicates the percentage of sales remaining after deducting cost of sales.

– Net Profit Margin: Measures the profitability of the company after accounting for all expenses and taxes.

3.Solvency Ratios:

– Debt Ratio: Evaluates the ratio of debt to equity used to fund company assets.

– Interest Coverage Ratio: Determines the company’s ability to pay the interest on its debt.

4. Efficiency Indicators:

– Inventory Turnover Rate: Evaluates the speed at which the company sells and exchanges its inventory.

– Accounts Receivable – Measures the efficiency of collecting income from customers.

Benefits of analyzing financial ratios:

– Evaluation of the financial results and stability of the company.

– Identify areas for improvement and potential risks.

– Compare your company’s results to those of other companies in the industry.

– Decision support for investors, lenders and stakeholders.

– Track company progress over time and evaluate the effectiveness of management strategies.

The financial ratio analysis is a valuable technique for assessing a company’s financial health and performance. By examining the relationships between liquidity, profitability, solvency and efficiency, analysts can gain valuable insight into business operations and make informed decisions. However, interpreting the metrics must take into account the broader context, industry standards and specific business circumstances. Regular analysis of metrics can provide valuable information for investors, managers and stakeholders to monitor and improve a company’s financial performance.

Below are the four financial ratios to determine if a company is profitable or not:

1. Gross Profit Margin:

Gross profit margin is a fundamental indicator of a company’s ability to generate profits from its core business. It represents the percentage of sales remaining after deducting the cost of goods sold (COGS). In other words, gross profit margin measures the profitability of a company’s key revenue-generating activities before operating expenses, interest and taxes.

Formula: Gross Margin = (Revenue – COGS) / Revenue * 100

In general, a higher Gross Margin is preferred because it requires effective cost management and pricing strategies. Companies with higher gross profit margins are better equipped to weather economic downturns and competitive pressures. It’s important to compare this ratio across industries, however, as margins can vary wildly depending on the type of business. For example, retail companies tend to have lower gross profit margins due to higher COGS, while software companies tend to have higher margins at relatively lower COGS.

2. Profit Margin:

Net profit margin measures the percentage of sales converted to net profit after accounting for all expenses, including operating expenses, interest, taxes and exceptional items. Unlike gross profit margin, net profit margin reflects the overall profitability of the business after considering all of the costs associated with operations.

Formula: Net Profit Margin = Net Sales / Sales * 100

A higher net profit margin indicates better profitability because it means that the company generates more sales than its sales. This also indicates that the company is managing its expenses effectively and operating efficiently. Investors and analysts often use net income margin to compare companies in the same industry to identify potential investment opportunities or assess the financial health of their existing portfolio.

3. Return on Investment (ROI):

Return on Investment (ROI) evaluates the return on investment by measuring the return achieved compared to the original investment. This indicator is particularly useful for evaluating the profitability of long-term projects, acquisitions or investments. By comparing the ROI of different investment options, companies can prioritize projects that offer higher returns and allocate their resources efficiently.

Formula: ROI = (Net Income / Initial Investment) * 100

A higher return on investment means the investment will generate a higher return, which means higher profitability. However, timelines and industry benchmarks should be considered when interpreting ROI.

Some projects may have a higher return on investment in the short term, but may not be profitable in the long term. Additionally, comparing the ROI of different industries may not be as meaningful as risk profiles and capital requirements can vary widely.

4. Return on Equity (ROE):

Return on Equity (ROE) measures the profitability of the company from the perspective of its shareholders. LAW. Measure the return generated by shareholders. Investment and shows how effectively the company uses its capital to generate profits.

Formula: ROE = Net Income / Shareholders’ Equity * 100

A higher ROE indicates that the company is generating significant returns compared to equity investments, indicating potentially profitable businesses. ROE is particularly important to investors and shareholders as it shows a company’s ability to generate a return on investment. However, high ROE can also be due to leverage when a company relies heavily on debt to fund its operations. While leverage can increase returns during profit periods, also increases a company’s risk and vulnerability during times of economic downturn.

Conclusion:

An analysis of these four financial metrics provides a comprehensive view of a company’s profitability and financial health. While Gross Profit Margin and Net Profit Margin focus on operational efficiency, ROI and ROI provide insight into the returns you are getting from your investments and capital. However, it is important to consider these metrics along with other financial metrics, industry benchmarks, and qualitative factors to gain a full understanding of a company’s profitability.

Regular monitoring of these metrics can help investors and entrepreneurs make informed decisions and identify opportunities for improvement to increase profitability and profits. It is important to note that financial reports should not be used in isolation, but rather as part of a broader analysis that considers a company’s industry dynamics, competitive environment and macroeconomic factors. By combining quantitative analysis with qualitative assessment, stakeholders can better understand a company’s profitability and make more accurate predictions about its future prospects.